Worker’s Compensation vs. Unemployment Insurance Benefits: Know the Difference

by Christine Muller

So, fun tidbit for the month of June, did you know June 27th is National Onion Day – so I’d thought I’d peel back the layers of HR a little and provide some context and definitions for some different layers, so to speak

Let’s test your knowledge –

Do you know the difference between Worker’s Compensation and Unemployment Insurance benefits?

Worker’s Compensation is a government mandated program designed to offer a type of business insurance that provides benefits to employees who experience work related injuries (or disability or illnesses- it provides medical expenses, lost wages, and rehabilitation costs to employees injured or ill in the course and scope of employment. It is mandated by each state and the wage and medical benefits may vary by state.

Unemployment Insurance provides financial benefits for workers who are unemployed through no fault of their own (a variety of circumstances covered) and a person who is actively seeking work is unable to find work (for example). It is a joint state-federal program that provides these benefits.

Basically, work comp covers an employee for injuries for which the employer would be liable while disability benefits cover injuries that prevent you from working but aren’t necessarily work-related. It is important to note that typically, work comp benefits last longer.

Now, let’s add in some more HR fun facts – and dice up all that onion!

Can an employee be on more than 1 type of leave at the same time?

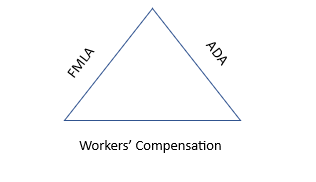

There is an HR ‘Bermuda’ Triangle we in the HR realm are oftentimes challenged with – which is where an employee will be on numerous types of leave all at once.

It can be very challenging to manage an employee’s need for leave while remaining compliant with “the Bermuda Triangle of leave laws” which exists in the space between workers’ compensation laws, the Family and Medical Leave Act (FMLA), and the American with Disabilities Act (ADA).

This is just one of the many ‘layers’ of HR and employment laws that we are able to assist you with!

For any of us who watched the coronation of King Charles III – we can’t forget about the World’s Biggest Onion – which received its crown for weighing in at 18 lb 11 oz! Wonder how many layers that onion had, yikes!!!

The Importance of Performance Reviews: A Win-Win for Employees and Employers

by Audrey Foster

Performance reviews play a crucial role in the success of any business. By providing regular feedback, both employees and employers can benefit greatly. In this blog post, we will delve into the significance of performance reviews, the frequency at which they should be conducted, and the importance of involving employees in the process. If you’re seeking assistance with constructing and delivering effective reviews, we are here to lend a helping hand!

The Purpose of Performance Reviews

Performance reviews serve as a comprehensive evaluation of an employee’s work performance and accomplishments over a specific period. They provide an opportunity for open and constructive communication between employees and their managers. The primary objectives of performance reviews are to:

- Set Expectations: Performance reviews enable employers to communicate expectations clearly, ensuring employees understand their role within the organization and align their goals accordingly.

- Recognize Achievements: Acknowledging employees’ accomplishments boosts morale, motivation, and job satisfaction. By highlighting their successes, employers demonstrate appreciation and encourage continued excellence.

- Identify Areas for Improvement: Constructive feedback during performance reviews helps employees identify areas where they can enhance their skills, address weaknesses, and grow professionally.

- Support Career Development: Performance reviews serve as a platform to discuss career aspirations, identify development opportunities, and create a roadmap for employee growth within the organization.

Frequency of Performance Reviews

Regular and timely performance reviews are vital for maintaining a productive work environment. While the frequency of reviews may vary across organizations, we recommend conducting them on a quarterly basis or, at the very least, annually. Quarterly reviews allow for more frequent feedback and course corrections, leading to continuous improvement. Annual reviews serve as a comprehensive evaluation of an employee’s overall performance, goals, and development.

Avoiding Surprises: The Role of Ongoing Feedback

Performance reviews should not be the first time an employee hears about their performance. Instead, they should serve as a summary of past conversations and feedback. Regular feedback and ongoing communication are essential in ensuring that both positive aspects and areas for improvement are addressed in a timely manner. Managers should provide continuous guidance, coaching, and support to their employees throughout the year, fostering a culture of open communication and growth.

Involving Employees in the Review Process

To enhance the effectiveness of performance reviews, it is beneficial to involve employees in the process. Encouraging employees to complete a self-review before the actual review session allows them to reflect on their own performance, strengths, and areas for improvement. This self-assessment provides valuable insights, opening the door for a more productive and collaborative discussion during the review. It also empowers employees to take an active role in their professional development, fostering a sense of ownership and accountability.

Seeking Support for Constructing and Delivering Reviews

Constructing and delivering effective performance reviews can be a complex task. It requires careful planning, clear communication, and a focus on both the employee’s and the organization’s goals. If you find yourself in need of support, our team is here to help. We offer guidance and expertise in constructing impactful performance reviews tailored to your organization’s unique needs.

Performance reviews are a valuable tool for both employees and employers. By providing regular feedback, setting expectations, recognizing achievements, and identifying areas for improvement, these reviews contribute to a productive and engaged workforce. Regular and ongoing feedback, along with involving employees in the review process, further enhance the effectiveness of performance reviews. Should you require assistance in constructing and delivering impactful reviews, our team is ready to assist you in optimizing this crucial aspect of your business operations.

Should You Start an S Corp?

by Rhonda Anderson

Similar to sole proprietors and partnerships, S Corps are pass-through entities. All business income is passed through to the owner. Unlike sole proprietors, LLCs and partnerships, however, the income passed through from an S Corp is not subject to self-employment tax, which amounts to 15.3%. The owner only pays income tax on their business’s income.

S Corps are required to pay their owners a reasonable compensation through payroll. Your business will pay FICA payroll taxes, 7.65% and you personally will have FICA taxes, 7.65%, withdrawn from your paycheck. Your wages are now a tax deduction for your business and whatever profit your business makes is not subject to corporate taxation or self-employment tax. This is where S Corps are advantageous. One of the primary reasons business owners form S Corps is the tax savings potential. Experts recommend if your business net profit is more than $60k, then an S Corp would be beneficial to you.

Health insurance premiums paid on behalf of greater than 2% shareholders are deductible by the S Corp and reportable as wages on the shareholder’s Form W-2, subject to withholding. These premiums are not subject to FICA or FUTA if premiums are made on behalf of an employee under a plan that makes provision for all or a class of employees. A 2% shareholder is eligible for an above-the-line deduction in

arriving at AGI (Adjusted Gross Income) for amounts paid during the year for medical premiums.

Additionally, earnings distributed to shareholders as dividends are taxed at a lower rate than income.

Other considerations:

S Corps cannot have more than 100 shareholders, but an LLC can have unlimited members.

S Corps cannot have non-U.S. citizens as members.

LLCs are allowed subsidiaries without restriction, while S Corps aren’t allowed subsidiaries.

LLCs cannot issue stock, while S Corps can, though only one class of stock.