Lawsuit and the Equal Employment Opportunity Commission

by Kim Keene

The Equal Employment Opportunity Commission (EEOC) released its 2023 employment discrimination lawsuit filings, and there is more than a 50% increase over 2022. The EEOC’s goal is to advance workplace opportunity by enforcing federal employment discrimination laws. Many changes have taken place at the agency in FY 2023, including new leadership, structural changes, and a significantly increased budget. The EEOC’s 2024 federal budget was increased by over $26 million, that means employers will likely see a surge in employment discrimination investigations. As a result, employers may see a continued increase in enforcement in the coming months and through next year. Therefore, it’s crucial that employers understand their legal obligations related to discrimination laws.

The EEOC’s last fiscal year – October 1, 2022 to September 30, 2023 – had 143 discrimination lawsuits occur, of those, 25 were systemic cases (about double the amount of systemic suits filed in the last three years), 32 were non-systemic class lawsuits, and 86 suits were filed on behalf of individuals.

The cases filed by the EEOC challenge workplace discrimination under all of the statutes enforced by the Commission and represent a broad array of issues, including barriers in recruitment and hiring, protecting vulnerable workers and persons from underserved communities, qualification standards and inflexible policies that discriminate against individuals with disabilities, the long-term effects of the COVID-19 pandemic, advancing equal pay, combatting unlawful harassment, and preserving access to the legal system. The agency’s litigation efforts also focused on single- and multiple-employee non-systemic class suits, challenging barriers in recruiting and hiring, qualification standards, and inflexible workplace policies the EEOC alleges discriminate against individuals with disabilities. The report also notes that the agency’s 2023 litigation docket continued its focus on litigation involving the long-term impacts of COVID-19 on certain workers, pay equity, and combating unlawful harassment.

An important focus of the EEOC is on systemic discrimination lawsuits (25 filed in FY 2023, double the number in the past three years). The EEOC defines systemic lawsuits as those that have a pattern or practice, policy and/or class cases where the discrimination has a broad impact on an industry, profession company or geographic location.

Industries that received the most lawsuits included:

- Hospitality (31 lawsuits)

- Health care (24).

- Retail (18).

- Construction/natural resources (15).

- Transportation/logistics (9).

Small businesses were also sued, including a pet store, a pet resort boarding and training service with two locations, an appliance store, a lodge in a state forest area, a small medical practice, and a used car dealership, among others. The Seyfarth report noted these small businesses may struggle to fund their legal defense against EEOC lawsuits.

This uptick in systemic lawsuits indicates the EEOC is pursuing class action employment litigation, like the nationwide age discrimination suit it settled earlier this month for $2.4 million. In that case, the defendant employer was accused of violating the Age Discrimination in Employment Act (ADEA) through its initiative to hire more millennials into its workforce, wherein it denied sales representative positions to applicants over 40 years old. Similar outcomes can be expected in the future as the EEOC’s systemic litigation initiatives continue.

Employers can mitigate the risk of discrimination lawsuits by ensuring they are building inclusive, welcoming cultures that set clear standards of conduct for all interactions, regardless of setting.

Employers are encouraged to:

- Closely and regularly examine their compensation structures to ensure parity and implement transparent processes for promotions to counteract pay equity disparities.

- Create a workplace culture that prioritizes diversity and inclusion, which is crucial in addressing gender- or race-based concerns.

- Review, update, or implement robust anti-discrimination policies, provide diversity and inclusion training, and foster an environment that values employees’ differences.

- Be mindful of stereotypes and biases associated with age and proactively address these within the workplace.

- Encourage cross-generational collaboration and provide training on age inclusivity.

- Prioritize flexibility and accessibility to ensure that employees with disabilities have the support they need to thrive in the workplace.

All employers are encouraged to conduct formal training to safeguard against illegal behavior and educate employees. Additionally, the core values and mission statements of organizations should include and reinforce such items as inclusion, accountability, respect, professionalism and transparency.

The settlement range for wrongful termination may be anywhere between $10,000 and $1,000,000, while a sexual harassment settlement averages around $120,000, and a hostile workplace settlement averages around $50,000.

For assistance in reviewing your practices related to the EEOC and other state agencies, please speak with your HR Consultant.

Sources: SHRM.org and EEOC.gov

Retirement Plans and ERISA Requirements

by Christine Muller

ERISA is a federal law that sets minimum standards for retirement plans in private industry. ERISA does not require any employer to establish a retirement plan, it only requires that those who establish plans must meet certain minimum standards.

ERISA does the following:

- Requires plans to provide participants with information about the plan including important information about plan features and funding. The plan must furnish some information regularly and automatically. Some is available free of charge, some is not.

- Sets minimum standards for participation, vesting, benefit accrual and funding. The law defines how long a person may be required to work before becoming eligible to participate in a plan, to accumulate benefits, and to have a non-forfeitable right to those benefits. The law also establishes detailed funding rules that require plan sponsors to provide adequate funding for your plan.

- Requires accountability of plan fiduciaries. ERISA generally defines a fiduciary as anyone who exercises discretionary authority or control over a plan's management or assets, including anyone who provides investment advice to the plan. Fiduciaries who do not follow the principles of conduct may be held responsible for restoring losses to the plan.

ERISA does not allow a service requirement of more than 1,000 hours per year for eligibility to participate. What does this mean for your organization and your employees? Part-time employees may be eligible if they work at least 1,000 hours per year, which is about 20 hours per week. Part-time employees may be eligible as well as full-time employees to receive these benefits from the employer.

To further complicate the issue of part-time eligibility though, the government recently passed the SECURE 2.0 Act, which despite what ERISA says requires “Long Time Part Time” employees to be given the ability to contribute even if they don’t work 1000 hours (this is all part of the effort to cover more people in retirement plans). This applies starting in 2025 to anyone who works between 500-999 hours a year in at least 2 consecutive years. Again, if they meet this but not the 1,000-hour requirement then they don’t get the match, but they can contribute if they wish.

What are some different types of Retirement plans?

Defined Benefit Plan: A defined benefit plan, funded by the employer, promises you a specific monthly benefit at retirement. The plan may state this promised benefit as an exact dollar amount, such as $100 per month at retirement. Or, more often, it may calculate your benefit through a formula that includes factors such as your salary, your age, and the number of years you worked at the company. For example, your pension benefit might be equal to 1 percent of your average salary for the last 5 years of employment times your total years of service.

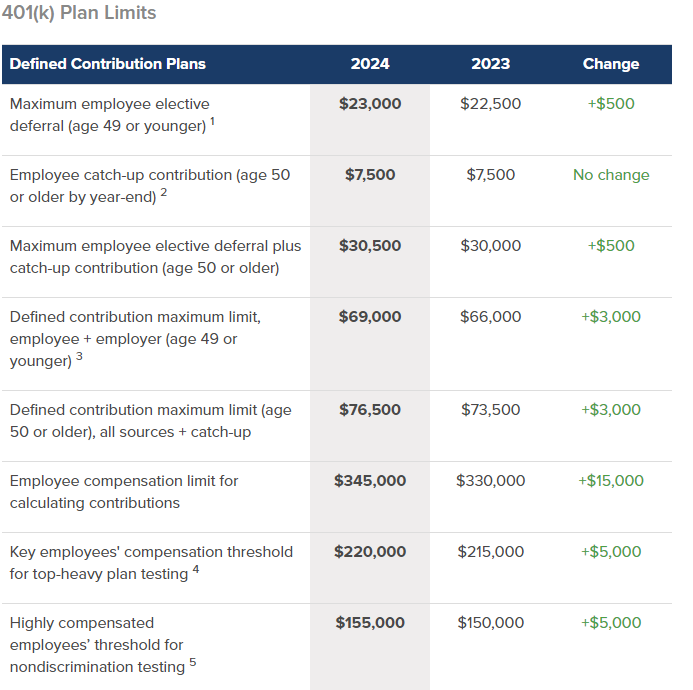

Defined contribution plan: A defined contribution plan, on the other hand, does not promise you a specific benefit amount at retirement. Instead, you and/or your employer contribute money to your individual account in the plan. In many cases, you are responsible for choosing how these contributions are invested and deciding how much to contribute from your paycheck through pretax deductions. Your employer may add to your account, in some cases by matching a certain percentage of your contributions. The value of your account depends on how much is contributed and how well the investments perform. At retirement, you receive the balance in your account, reflecting the contributions, investment gains or losses, and any fees charged against your account. The 401(k) plan is a popular type of defined contribution plan. There are four types of 401(k) plans: traditional 401(k), safe harbor 401(k), SIMPLE 401(k), and automatic enrollment 401(k) plans. The SIMPLE IRA plan, SEP, employee stock ownership plan (ESOP), and profit sharing plan are other examples of defined contribution plans.

Simplified employee retirement plans (SEPs): Simplified Employee Pension Plan (SEP) – A plan in which the employer makes contributions on a tax favored basis to individual retirement accounts (IRAs) owned by the employees. If certain conditions are met, the employer is not subject to the reporting and disclosure requirements of most retirement plans. Under a SEP, an IRA is set up by or for an employee to accept the employer's Contributions.

401(k) plans: 401(k) Plan – In this type of defined contribution plan, the employee can make contributions from his or her paycheck before taxes are taken out. The contributions go into a 401(k) account, with the employee often choosing the investments based on options provided under the plan. In some plans, the employer also makes contributions, matching the employee's contributions up to a certain percentage. SIMPLE and safe harbor 401(k) plans have additional employer contribution and vesting requirements. What are profit sharing plans or stock bonus plans?

Profit Sharing Plan – A profit sharing plan allows the employer each year to determine how much to contribute to the plan (out of profits or otherwise) in cash or employer stock. The plan contains a formula for allocating the annual contribution among the Participants.

*Source: IRS Revenue Procedure 2023-23.

*Department of Labor and Industry-Employee Benefits Security Administration 2024.

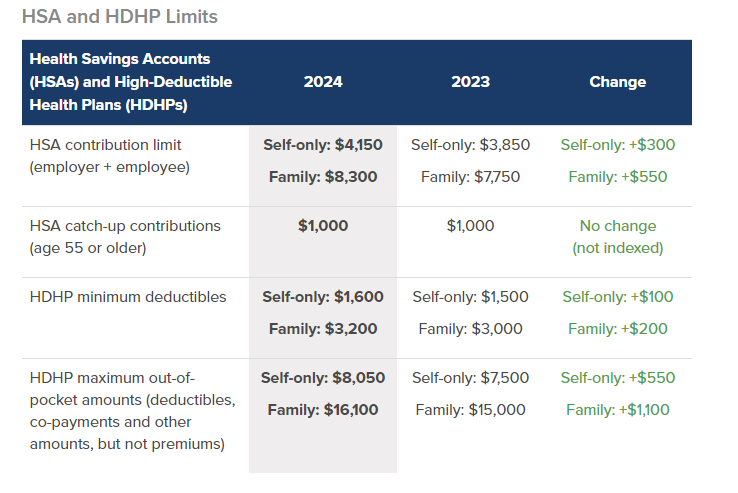

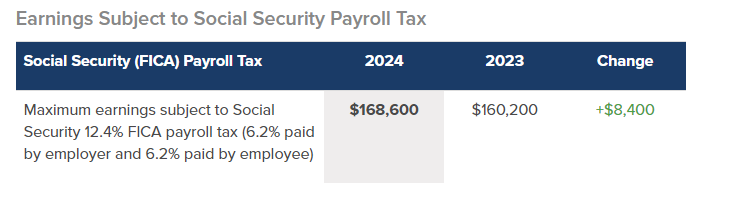

2024 Benefit Plan Limits & Thresholds

by Rhonda Anderson

What are the Substance Use Concerns of Workplaces Past, Present, and Future?

by Christina Carmona

Workplaces Past – Smoking

Readers may recall the days of old when workplaces were full of cigar and cigarette smoke. Now, all but six states (Kentucky, Mississippi, North Carolina, Texas, Virginia, and Wyoming) explicitly prohibit smoking in all or some indoor private sector places of employment. Increasingly, these indoor smoking prohibitions also include prohibitions on vaping indoors.

Nevertheless, while employers can prohibit tobacco use in the workplace, many states have laws that prohibit discrimination based on off-duty conduct such that employers cannot discriminate against current or prospective employees who smoke, vape, or engage in legal use of tobacco products while they are not working.

Workplaces Present – Alcohol and Marijuana

Employers can prohibit the use of alcohol in the workplace and prohibit employees from being under the influence of alcohol while working. This is particularly true for employers that allow (and provide) alcohol at work events. If alcohol will be served at an event, there are simple ways to reduce the likelihood that attendees overindulge. For example, consider hiring a third- party bartender and/or issuing employees a limited number of drink tickets. A cash bar might also discourage excessive drinking. Perhaps limit the types of alcohol offered to beer and wine, and serve food at the event. Employers should set concrete hours for the event and ensure that non-alcoholic beverages are available. Employers could also coordinate designated drivers or sponsor rides home as needed.

Marijuana use has become an increasingly hot-button issue around the country. Federal law prohibits marijuana use for both medical and recreational purposes. However, the vast majority of states permit medical use in some form and almost half of states further permit recreational use. Along with recent legalization of marijuana in various jurisdictions, we are seeing more restrictions on drug testing for marijuana. Some states prohibit employers’ ability to drug test prospective employees or current employees absent a concern that they are impaired. For example, in New York, an employer may only take action related to recreational cannabis use in certain instances, such as to comply with another law, to avoid violating federal law, or if the employee “manifests specific articulable symptoms while working that decrease or lessen an employee’s performance of the duties or tasks of the employee’s job position, or such specific articulable symptoms interfere with an employer’s obligation to provide a safe and healthy work place…” Philadelphia, for example, prohibits employers from requiring a prospective employee from submitting to testing for the presence of marijuana as a condition of employment, except for certain positions such as law enforcement, commercial drivers, and other professions.

Because individuals can test positive for marijuana on certain drug tests even when they are not impaired or under the influence at the time of the test, employers must exercise caution in utilizing certain drug tests to prohibit off-duty conduct.

Even with marijuana legalization, employers can always prohibit the use and possession of marijuana, and other drugs, in the workplace and mandate that employees not be under the influence of marijuana or other drugs during working hours and at work-sponsored events.

Workplaces Yet to Come – Psychedelics

And finally we turn to the new frontier in drug legalization – psychedelics. While the legalization of psychedelics is still limited, their use for medical and recreational purposes is an increasing point of discussion.

In 2020, Oregon voters approved the Psilocybin Services Act. The Act permits the therapeutic use of psilocybin by qualifying individuals age 21 and over with specified mental health conditions. This law took effect on January 1, 2023. Of interest to employers, the Act expressly states that it cannot be construed to amend or affect state or federal law pertaining to employment matters.

In Colorado, voters approved a new law, effective January 1, 2024, permitting the cultivation, sale, and administration of certain natural psychedelic medicines, including psilocybin and psilocin, the psychoactive chemicals in psychedelic mushrooms.

In the employment context, the new Colorado law does not require employers to allow or accommodate the use, consumption, possession, transfer, display, transportation, or growing of natural medicines in the workplace. A few other localities, including Portland, Maine, Minneapolis, and San Francisco, have passed ordinances decriminalizing psilocybin. Further, a number of state bills are pending that would similarly decriminalize the use of psilocybin. Notably, most of these bills would not require employers to accommodate the use of Psilocybin.

In summary, substance abuse concerns continue to provide challenges for employers. Employers should continue to stay apprised of new laws and revisit their drug and alcohol-free workplace and testing policies on a regular basis.

Source: Littler Workplace Policy Institute